In the digital economy, business leaders are facing an increased pressure to steer their organization towards digital transformation. The business challenges surrounding the enterprise are compelling the leaders to formulate a cohesive digital transformation strategy. On one hand, the complex business environment with diverse sets of challenges serves as an opportunity to capitalize on the digital revolution and on the other hand it places the accountability to do this right.

The technological advancements of hyperconnectivity, cloud computing, blockchain, robotics, and artificial intelligence, to the possibilities of reimagining new business models of personalized, and subscription-based products and services, to providing intuitive and modern user experience to employees and business partners are serving as a stimulus for a well-defined, value-based business transformation approach.

Opportunity to Transform

The CFO’s are driven to rethink finance and acquire strategic capabilities with a focus on fast time-to-value and future-proof solutions. The reimagined digital finance organization is agile, strives for value creation to the achievement of overall corporate objectives, and is a model for operational excellence.

If your enterprise is using SAP ECC today, you are obviously planning to move to S/4HANA at some point in the future to realize the benefits of the innovations in S/4HANA solution. However, your path to S/4HANA may involve choosing the right option that best meets your criterion from the alternative paths of, new implementation, conversion, or selective migration. Further, in the pursuit of realizing the benefits of the S/4HANA innovations, you may want to consider S/4HANA Central Finance as an avenue to move from your current ECC system(s) to S/4HANA, if any or all of the following challenges describe your situation:

- Firstly, complex landscape with multiple ERPs

- Highly Customized ERP

- Suboptimal Data Quality

- Obsolete Enterprise Structures

- Lack of Agility

- Inadequate Reporting Dimensions

- Inflexible in easily integrating newly acquired businesses

- Finally, difficulty in Common, Centralized Financial Reporting for the Enterprise

Central Finance Deployment Approach

A Central Finance deployment approach is one of the favorite approaches for companies that are operating on multiple ERP and highly customized systems because it allows companies to achieve faster time-to-value of S/4HANA solution capabilities without making any changes to their existing systems. You can start with optimizing financial operations followed by bringing other processes into the digital core in an incremental manner.

Use Cases for Central Finance

- Merger and Acquisitions – Provide a structured framework and repeatable process for integrating new business and managing it more effectively and efficiently. No more uploading of monthly trial balances as it does not give the visibility and opportunity to make timely decisions.

- Subsidiary Integration – For a subsidiary operating on a cloud ERP or non-Sap system for which there is no intent for bringing them onto the common platform, there may be benefits integrating them into Central Finance for central reporting and processes.

- Financial Data from SAP and non-SAP systems – Operating in a complex environment with multiple SAP and non-SAP systems that are quite varied in terms of versions, data, and configurations it is very difficult to do common, streamlined reporting. Leverage Central Finance option to bring the financial data into Central Finance for common reporting and shared operational finance functions.

- Migrate to Cloud Platform – Central Finance can be deployed On-premise or Cloud. Leverage this as an opportunity to move to cloud infrastructure to reduce the cost of ownership.

- Harmonize and Centralized Data Management – Harmonized and streamlined data is an essential pillar for Central Finance implementation. When setting up Master Data Governance (embedded or as a hub), data harmonization and centralization will be achieved for long term objects e.g. Business Partners, Cost Centers, etc.

- Shared Services and Centralized Finance Functions – Implementation of Central Finance leads to setting the foundation for Finance Shared Services. With common processes, many of the processes may be transitioned to a shared services framework. For example, a cash application, treasury, collections, etc.

- Consolidate Disparate ERP Systems – To reduce the footprint of multiple ERPs, Central Finance deployment approach can be an option. Build out S/4HANA system incrementally and gradually decommission legacy applications to optimize the landscape.

Implementation Approach, It’s a journey…

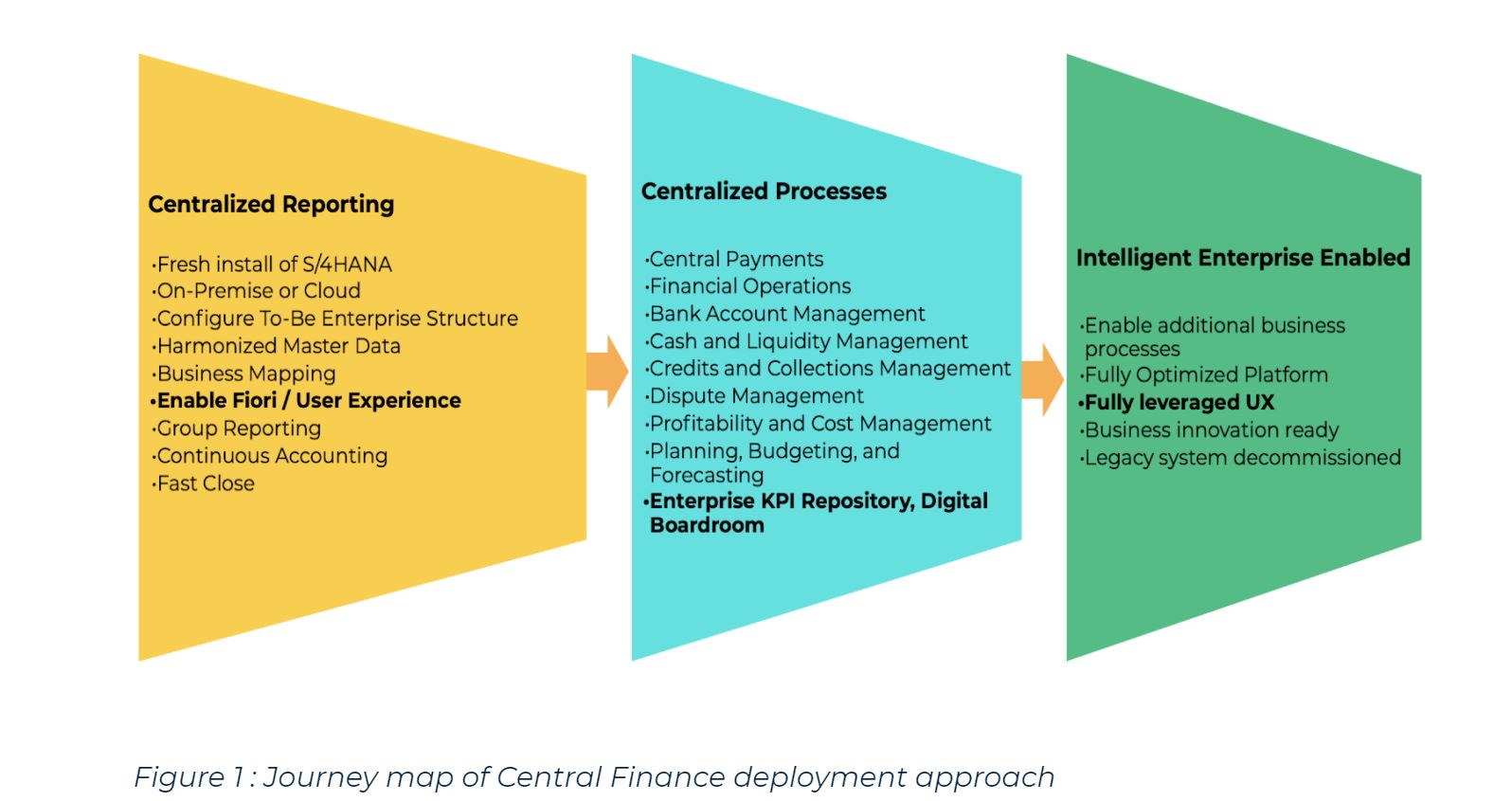

One of your biggest priorities is to reduce the risk to business and operations in undertaking the move to S/4HANA. Therefore, we recommend a value-based step approach. However, the diagram below reflects a view of the journey map.

Emphasis on User experience

As you embark on the digital transformation journey, it is critical to keep User Experience at the center of the transformation strategy. However, in order to realize the full benefits of the investment, the user experience aspect is vital. It not only facilitates the modern and intuitive way of doing work, it fosters a culture of working smart. Therefore, your enterprise will be able to attract, retain top talent, enhance your business partners’ experience, and improve efficiency.

Mindset Advantage

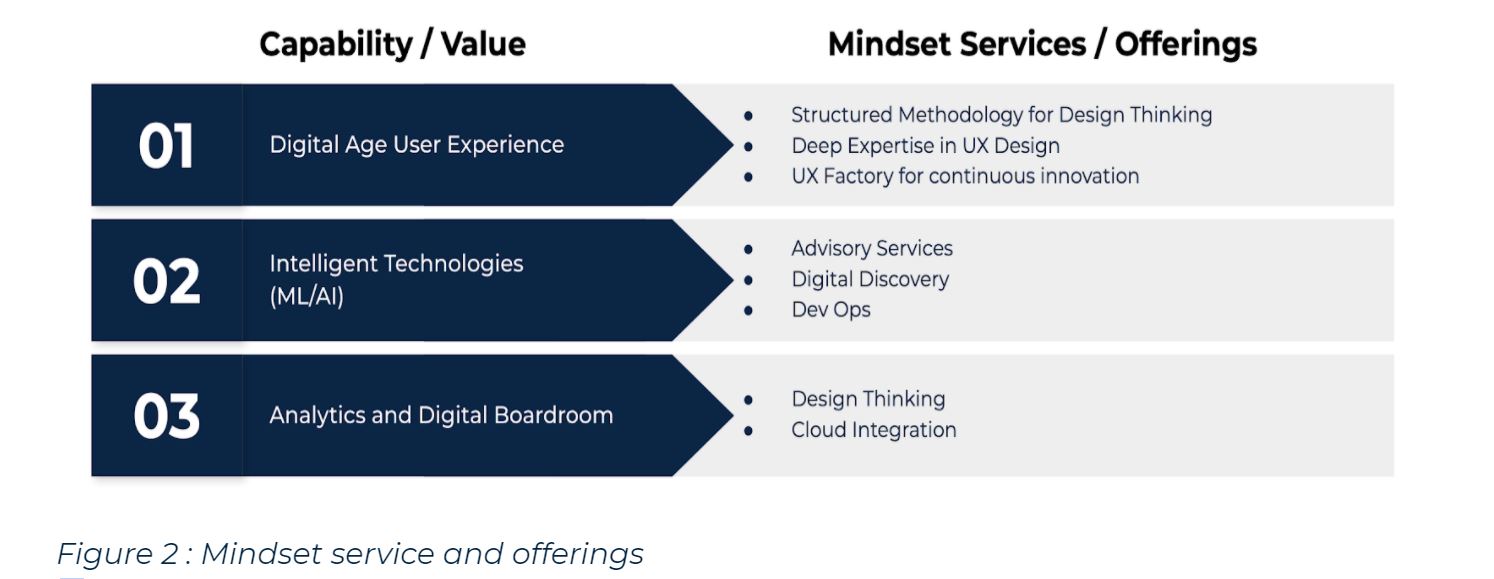

In conclusion, we at Mindset specialize in making SAP beautiful. We are here to help you achieve the value from your S/4HANA Central Finance Implementation Program. However, below is a depiction of the capability / value map and our service offerings:

For a more detailed discussion on the topic please attend the upcoming Webinar on January 13, 2021 presented by me and Naveen Rokkam. Register HERE

If you are interested in viewing similar articles, visit our blog, here.

View our LinkedIn, here.