“The consequences of this breakthrough are hard to overstate.” — Marc Andreesen, creator of Mosaic Browser, speaking about Bitcoin.

It’s inevitable that you have read something about Blockchain in the news, heard about it through a friend, or at least heard the term Bitcoin. Satoshi Nakamoto, a person or persons that designed Bitcoin and ultimately popularized blockchain by solving many of the inherent problems with a peer to peer electronic cash system. I won’t go into details here, but the main theme is to eliminate third parties by creating systems that can intrinsically be secure, trusted, preserve user privacy and rights, distributed data, rewarding to those who provide value and the inclusion of all.

Blockchain is the next big thing after the Internet…

Why do we need a chain of blocks?

Since the inception of the internet, technologists have been trying to figure out a way of guaranteed and trusted delivery of passing value and information from point A to point B. In the early days of the internet, payment processing was not very secure, so there have been a multitude of methods to tighten up the security of payment processing,

The traditional method was to use a middleman, who is trusted implicitly by both parties. Consider sending from your money from one country to another. Usually, you have to go to a location, like Moneygram. You use your debit card for the amount of money you want to send plus a fee for the service, then the money is transitioned from the point your bank account to the Moneygram, and is available to the person overseas within a few hours. Or is it?

Why Blockchain is Disruptive

In reality, your debit card goes through a series of systems both from the bank to Moneygram, that takes time to actually settle a payment. This could be several days before it actually makes it to the Moneygram account. This process takes time due to antiquated processing techniques, nothing is from one account to another, and financial institutions use this time to make money off of “the float”. This is the period of time that money exists in two different places, while the settlements complete. Meanwhile, that money is still available for the institution to do what they please, gives time to back out, or be denied somewhere in the process further extending the time both parties are without what is due. Now replace the word “money”, with the word “value” and you can start to see why how this example expands what might be done with blockchain.

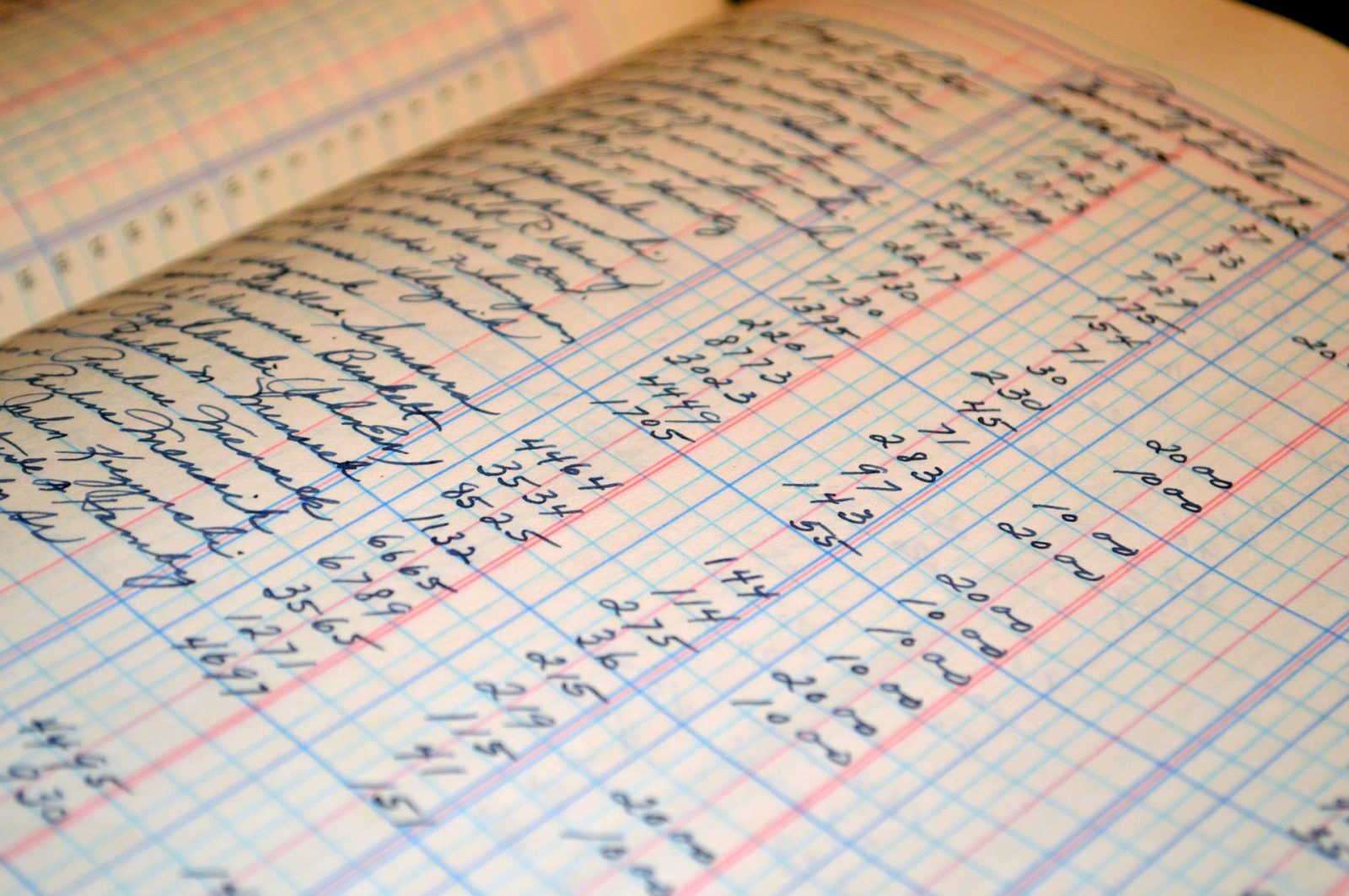

Blockchain removes all of that clunky processing, so that transfer of value is direct, without a middleman, and is irrefutable. It is recorded to a ledger and is securely processed by the network without revealing any information that is deemed sensitive. The blockchain transaction is distributed, encrypted, independently validated and verified, and recorded to a continuous ledger that prevents modification without corrupting the entire ledger.

It’s Not Just a Database

In order for a blockchain to work, there must be a way to trust all of these transactions being posted by potentially anonymous users. A blockchain is more than just a spreadsheet or table of transactions that grows and grows. It is rather a protocol that embeds integrity to the process, by preventing loopholes and removing a time-consuming settlement process. The goal is to improve the security, stability and removing a central point of attack for the exact same information. Once information is introduced to the blockchain, it must be verified at random, but participants of the distributed network, to which there must be consensus to prevent using something of value, more than once.

Since the blockchain is distributed, there are different topologies that could be used.:

- Public – This blockchain is like Bitcoin, everyone, no matter economic standing or geographic location have access.

- Private – Controlled by a central entity. Only the chosen can execute an exchange, verify/validate an exchange (mine) or audit the ledger.

- Consortium/Federated – Owned by a consortium, not a central authority. Only accessible to members of the consortium, and operated equally between the consortium members.

How Transparent?

Blockchain ledgers are transparent to those that are part of a blockchain network. While there is encryption and the ability to provide a level of anonymity to the characters using the blockchain, it is not impossible to trace the transfer of value from one persona to another. For instance, with Bitcoin, there is the possibility that if a person were to know the signatures of two parties making an exchange, then you could potentially identify the transaction between one wallet to another, and link that information to another system that has recorded identity information. Great article about this here: https://www.sciencemag.org/news/2016/03/why-criminals-cant-hide-behind-bitcoin

Companies have worked very hard at collecting data about their customers and the data is very identity specific. Like the name, address, phone numbers. Perhaps even SSN, Credit Card or Bank Account info, etc. That information is stored away for future use and that is where there have been significant consequences, when hackers gained access to this information, directly impacting their customers. The risk of this information being leaked or encrypted for ransom is quickly becoming too great. Some companies that have been victimized by this hacking or data ransom are starting to understand the value of dissociating data to an identity and anonymizing the information.

Smart Contracts

If we are to automate the middlemen, then we must create a platform that shall include their services. One of these services is brokering what is expected when exchanges are made, such as currency for land. The exchange can only be made if a set of criteria are completed. For instance, money must be held in escrow by a certain timeline to complete the exchange so that it protects the buyer and seller in case one person might back out. You wouldn’t want to buy land, and then when you go there, find that it has been sold to someone else.

Smart Contracts can use the blockchain to observe transactions and watch the timeline of events, to either release the funds for transfer to the seller or to forfeit the escrow if the buyer backs out, wasting the time of the seller. Smart Contracts can be coded for any criteria that can be automated on the blockchain.

How Does This Affect My Business

Just as the internet impacted how you connected to your customers, the blockchain will affect how our economy works. How we pay vendors, rebates to our customers, moving assets from one company to another, transferring land, registering birth records, tracking the providence of food, tracking recalls for manufactured items, direct purchasing of artist content, buying food from a farmer or renting a room all without paying for third-party fees. Businesses that do not adapt or force their own innovation lag forward, may find they have been left behind and go the way of giants like Blockbuster or Sears.

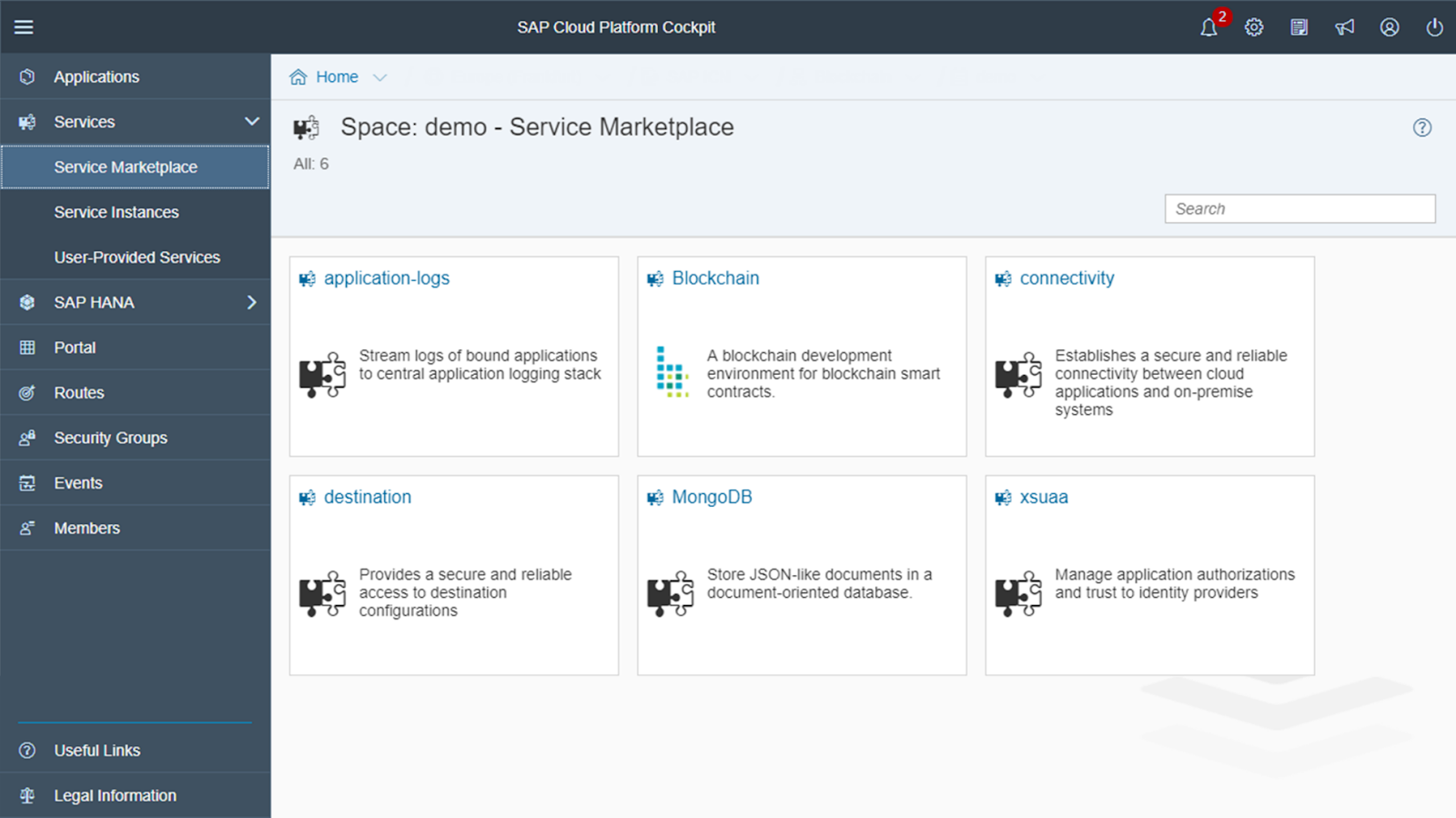

SAP Cloud BlockChain as a Service

SAP has now started to pull back the veil the Blockchain as a Service offering which will be on the Cloud Foundry environment. Here you an build blockchains utilizing the public, private, and consortium topologies to accelerate Enterprise use cases. At the time of this blog, there is no publicly available trial to test drive. However there is a early access link available to request access.

There are not surprisingly support private blockchain networks and that is HyperLedger Fabric and MultiChain. These are more geared to B2B scenarios instead of B2C like Ethereum’s blockchain. Both perform similar functions, but have their own strengths. HyperLedger fabric is explained in this video

Similarly, MultiChain has released a whitepaper on their product here: https://www.multichain.com/download/MultiChain-White-Paper.pdf

If you are interested in viewing similar articles, visit our blog, here.

View our LinkedIn, here.