Since the beginning of the internet, there has been a desire to send money from one party to another. Besides sending cash or check through the mail, the options were reliant on the sender and receiver being trustworthy, and the money being exchanged wasn’t lost in transit. Today, we handle these exchanges with payment processing companies or other financial institutions that guarantee funds and delivery, but they take their share of the transaction. What if there was a way to make the exchange of goods, resources, and services unimpeachable AND decentralized? Meet Blockchain, a “thing” created to facilitate peer-to-peer transactions, without a third party:

High-level features of a modern blockchain include:

- Decentralized peer to peer trades

- Transparency to all parties with access to the network

- Record of transaction (block) and subsequent transactions (blockchain) to a ledger

- Encryption to prevent alteration to verified blockchains

- Distributed ledger to all using or observing the blockchain to promote data integrity

A Brief Look at the History of Bitcoin

In 2007, Satoshi Nakamoto allegedly started on a concept called Bitcoin. While the identity of this person hasn’t been confirmed, there is speculation that Satoshi is actually is a group of individuals. The concept was clear, to create an all-electronic version of cash that would remove the need for financial institutions, utilize distributed networks and processing to outpace any possibility for attackers to hack an unauthorized change, and to digitally sign the transactions to elongate the time necessary to complete an attack.

Interesting Dates for Bitcoin:

- October of 2008, Satoshi had published a whitepaper (good read for the technically inclined) describing the intent of Bitcoin.

- October of 2009, the exchange rate is established by New Liberty Standard of 1 USD = 1309.03 Bitcoin (BTC) which included the price of electricity to run the computer.

- February 2010 the first Bitcoin Exchange is created by Bitcoin Market.

- Sometime in 2011, a marketplace for illicit drugs is launched on the TOR network, using Bitcoins as the only purchasing option

- September 2012, Bitcoin Savings and Trust is investigated for running a Ponzi scheme and devaluing Bitcoin by 30%

- April 2013, 1 BTC = $100 USD

- August 2013, Germany recognizes Bitcoin as private money and becomes tax exempt if held for more than 1 year

- November 2013, 1 BTC > $1000 USD

- December 2013, 96,000 Bitcoins are stolen from Sheep Marketplace, a Darknet website valued at $220 Million

- December 2013, China Bans Bitcoin transactions

- August 2015, Barclays starts accepting Bitcoin

- July 2016, Researchers find that “sin” activities now only account for about 3% or less of Bitcoin transactions

- August 2017, Bitcoin has a hard fork between Bitcoin Classic and Bitcoin Cash

- December 2017, 1 BTC = $11,700 USD

Imagine if you had spent $27 for 5000 Bitcoins in 2010, today they would be worth $58.5 Million!

Ethereum

Ethereum is like Bitcoin, but with a blockchain app platform. It is worth mentioning because of Smart Contracts. Contracts must be satisfied before the transactions complete, giving a more resilient transaction that other applications can be built on. For example, I could create a Smart Contract that sends all of my Ether (the currency) to another wallet in the event of a contract condition is met. Such as a date has passed or I stopped contributing to my wallet. Some real world examples are a will or a futures contract.

The Blockchain Vision for the Enterprise

How might we apply this same technology that has been so successful for a digital currency? The applications to Blockchain are virtually limitless, but the primary considerations that I feel are important are:

- Blockchains can be private, semi-private or public.

- Data synchronization and encryption will occur from multiple sources to keep the ledger up to date.

- Blockchains will be disruptive because they are meant to share information that we might have previously considered private (SAP tries to address this concern). While this disrupts some of our data security paradigms, it also forces innovation in competitive areas

- The more nodes you have participating in the network, the more processing power. Don’t expect performance gains without actually distributing the workload.

- If you have a private blockchain, with only 1-2 nodes you haven’t really removed the middleman, but you may have a cheaper transaction and are secure in knowing that those are the only validators of the blockchain

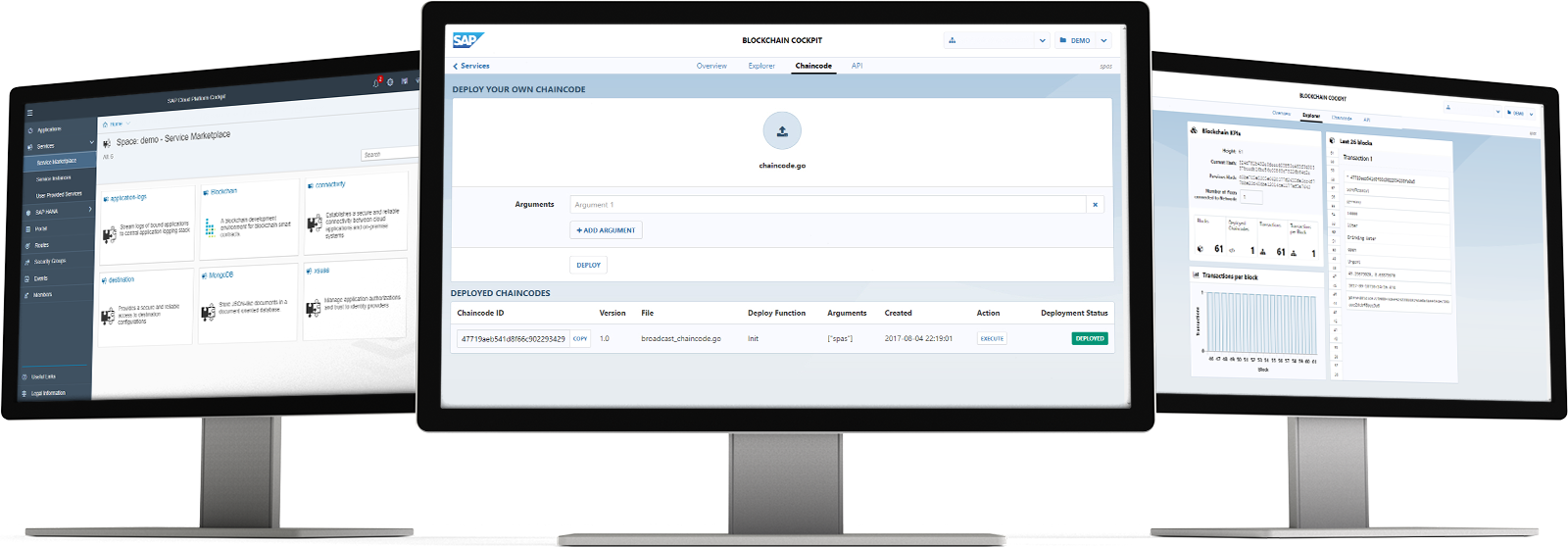

SAP Cloud Platform will support 4 Types of Blockchains

- Consortium – Semi-private, except only highly trusted entities may add and verify new blocks, and lower-trusted entities can observe the blockchain, but may not verify or

- Semi-Private – Similar to a Consortium, except it is a non-decentralized blockchain that is operated by a single entity, and other entities are given access.

- Private – Used inside of an organization in a traditional private database type model.

- Public – Shared with everyone. Anyone can submit transactions and verify blockchains. Just like Bitcoin and Ethereum

Ten Ideas for Blockchain

Here are 10 random ideas for blockchain for your consideration. Please leave me a comment or email me at andy@mindsetconsulting.com if you have any questions about Blockchain.

- Public Records – In some countries, Blockchain is already being used to register land deeds

- Asset Monitoring or Tracking – Using IoT, we can register the location or conditions of expensive machinery

- Health Care – Patient Records and prescriptions could be tracked between institutions

- Supply Chain – Shipments can be openly tracked between vendors

- Airlines – Please use blockchain to track my luggage!

- Manufacturing – A customer could track their product from production to shipment to their door or vice versa

- Agriculture – Food safety traceability from farm to the grocery

- Medical Devices – Trace artificial limbs, joints, or implants to patients

- Real Estate – Home information including deeds, construction, listing, selling and attributes associated

- Pharmaceuticals – Track R&D spending for FDA reporting

If you are interested in viewing similar articles, visit our blog, here.

View our LinkedIn, here.